The property market slogged through the dreary economic conditions and still came out with an increase in value of dwellings for the June quarter (April, May, June).

Despite value increases nationwide, it's clear that the health of the property market varies significantly depending on which capital city you focus on. There's no such thing as 'national' property market as price trends swing significantly depending on which side of the border you're on.

Yes, the total value of dwellings in Victoria dropped by $5,124.4 million, which may sound significant but represents just a 0.19% decrease from the previous quarter.

In terms of absolute value, Queensland saw the largest increase at $78,549.1 million, followed by NSW with $60,064.8 million, and WA with $68,769.6 million. Meanwhile, SA, ACT, TAS, and NT experienced smaller growth.

However, when looking at percentage changes, WA led with a 6.58% rise in total value, followed by SA at 4.5% and QLD at 4.1%.

Sydney's increase was comparatively modest at 1.44%, which was higher than TAS and VIC but lower than the NT and ACT.

Total value grew in all states and territories except Victoria.

Is this suggesting that the Victorian property market is collapsing or in crisis? Absolutely not.

Victoria holds the second-highest value of dwellings at $2,648.5 billion, higher than Queensland at $1,995.9 billion, but lower than New South Wales, which leads at $4,237.2 billion.

Focusing on the states, we observed that NSW added 16,800 dwellings, bringing the total to 3.467 million, an increase of 0.49%.

In comparison, Victoria saw an increase of 15,900 dwellings, bringing its total to 2.942 million, a growth of 0.54%, while Queensland added 11,500 dwellings, totaling 2.254 million with a 0.51% rise.

This data suggests that although Victoria is not experiencing the same value growth as other states, its percentage increase in properties is significant and may contribute to stabilising or reducing property values in the future.

Why has Victoria seen a decrease in value?

CoreLogic recently announced that Melbourne's median dwelling value is less than Sydney, Brisbane, Canberra, Perth and Adelaide.

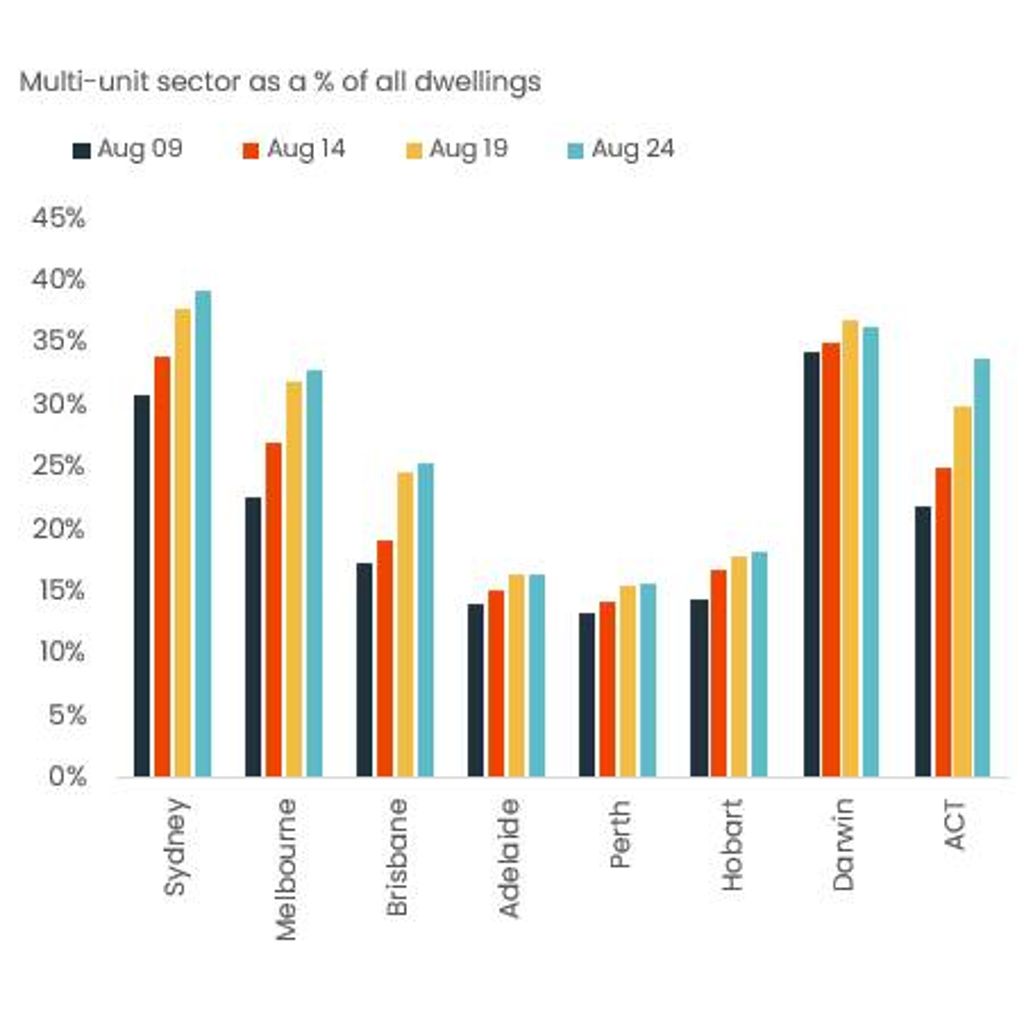

According to Tim Lawless, Executive, Research Director for Asia-Pacific for CoreLogic, another reason for the decline in median value is due to Melbourne densifying "more substantially and rapidly than the midsized capitals".

CoreLogic have estimated that a third of housing stock in Melbourne falls within the multi-unit sector, compared to 25% in Brisbane and 16% in Adelaide and Perth.

ABS data shows a 21.84% increase in the amount of sales for attached dwelling (units/apartments) for sale in Victoria compared to a 20.12% decrease in the amount of sales of established houses.

There are a couple of reasons as to why the total value of Victorian dwellings decreased by 0.19%.

One reason is due to the land tax implications for investors and stronger de-incentives for foreign investors to partake in Victorian property has seriously hampered sales.

As it costs more for investors/landlords to hold onto investment properties due to increased land taxes we are seeing less investors enter the market in Victoria. On the flip side, more apartments and units are on the market in Victoria than other states due to investors selling up and reinvesting elsewhere in the country.

Due to unit values usually being much lower than house values, this skews the price data for Melbourne down significantly and impacts it's overall property value.

It should also be noted that Sydney's housing is made up of approximately 40% dwellings in the multi-unit sector, however the price points for medium to high-rise apartments in Sydney are much higher (especially if they have water views!).

The June Quarter data increased the total value of dwellings in Australia by $225.9bn, bringing the total value of dwellings to $10,911.8bn.

Over the same time period, there was an increase of 52,900 dwellings in Australia, totaling 11.211m.

It is likely that the number of new dwellings is actually higher than 52,900, but the data factors in properties that have been demolished.

The average property price for a residential dwelling in Australia during this quarter also rose by $15,600 to $973,000.

On the back of steadying interest rates and a stable, if slowing economy, the property market has maintained it's forward momentum, even in the face of a housing crisis.

It will be interesting to see what will happen to the Melbourne property market over the spring selling period.

This article was originally published from view.com.au and appears with permission.